After Stunning Phase III Results, Ophthotech Seeks a Path Forward

After disappointing Phase III results of Fovista (pegpleranib) in combination with Lucentis (ranibizumab, Genentech) sent its stock reeling, Ophthotech Corporation is reevaluating not only the trial data but also how the results will impact ongoing Fovista combination trials as well as its overall business.

And while Ophthotech may have the equivalent of financial pneumonia, if not something worse, Novartis, Roche, and Genentech – all of whom are wrapped up in development agreements with Fovista – seem to have at least caught a cold.

David Guyer, MD, CEO and chairman of Ophthotech, told analysts on a call Monday morning that he and his team first saw unmasked data from the Phase III trial after the market closed Friday, December 2. “To state the obvious, we were simply stunned looking at the data from both trials,” he said. Fovista targets the platelet-derived growth factor (PDGF) pathway in degenerative retinal disease, whereas Lucentis targets vascular endothelial growth factor (VEGF).

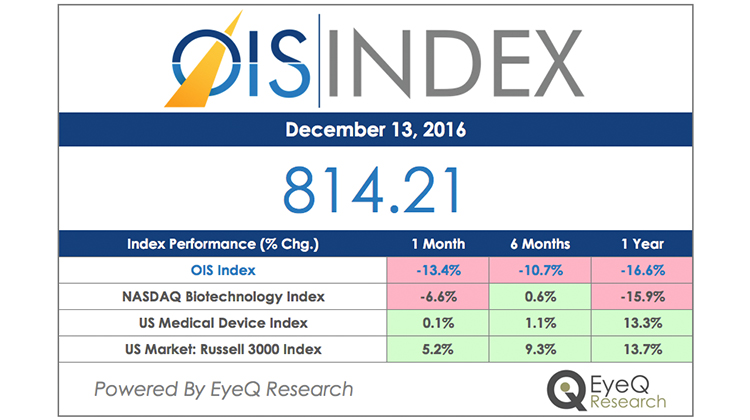

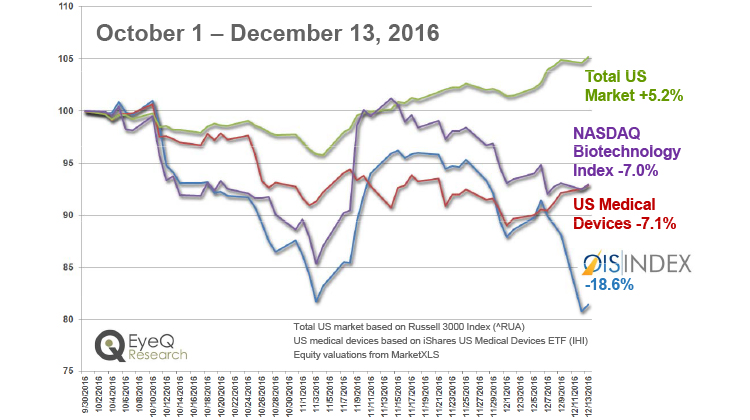

OIS Index – Performance Since Inception

Disappointing clinical trial results have had an impact on the OIS Index.

View OIS Index Performance Percentage

Two clinical trials, OPH1002 and OPH1003, evaluated Fovista 1.5 mg in combination with Lucentis versus Lucentis monotherapy in patients with wet, or neovascular, age-related macular degeneration (AMD). The results did not show any appreciable difference between the two arms. The combined analysis from the two trials showed that the Fovista-Lucentis group gained a mean of 10.24 letters at 12 months versus a mean gain of 10.01 letters for Lucentis monotherapy.

In the pooled analysis of pre-specified secondary endpoints from both trials, 24.2% of the combination arm gained 20 or more letters from baseline after 12 months compared with 22.1% of the Lucentis monotherapy arm. The pooled analysis also showed that 13.5% of patients receiving Fovista combination therapy achieved visual acuity of 20/25 or better at month 12versus 13.9% of patients on Lucentis monotherapy.

On the news of the trial results, Ophthotech’s stock price tanked around 87%, plunging from $38.74 at the opening bell Monday to $6.20 shortly afterward and closing at $5.13 on Tuesday.

The Phase III results were so striking because Phase IIB results, posted online in Ophthalmology in October, showed a statistically significant vision gain with Fovista combination compared with Lucentis monotherapy at 24 weeks: 10.6 versus 6.5 letters.1

Samir Patel, MD, Ophthotech president and vice chair, told the analysts that investigators will continue to collect two-year data in the Phase III studies reported this week.

The results raise questions about Ophthotech’s other ongoing trials – the Phase III trial of Fovista in combination with Avastin (bevacizumab, Genentech) and Eylea (aflibercept, Regeneron); and the Phase II/III trial of the complement factor C5 inhibitor Zimura (avacincaptad pegol sodium) for geographic atrophy. As for the former, Dr. Guyer told analysts the trial is fully enrolled with results expected in the second half of 2017, adding, “We haven’t made any decisions as of now while we’re in the process of further understanding the results of OPH1002 and 1003.” The Zimura program, he said, remains “on track and unaffected.”

But these results also have Ophthotech taking a look at the bigger picture, Dr. Patel told the analysts. “We are also continuing to assess impact of the Phase III results on operational, financial, and developmental matters for Ophthotech,” he said, noting an update would be forthcoming “when we have more information to report.”

Ophthotech had $321.2 million in cash on hand as of September 30 and no debt, COO and CFO Glenn Tyler reported to the analysts.

In 2014 Ophthotech entered into a licensing agreement for foreign rights to Fovista with Novartis, receiving $200 million up front and another $100 million in milestone payments since then. Vasant Narasimhan, MD, global head, drug development and CMO of Novartis, said the company is analyzing the recent Phase III data with Ophthotech. “We are confident that underlying data will provide further understanding and guidance on how best to help patients with this disease,” he said.

“Novartis continues researching new treatment options for patients with AMD, and we are looking forward to the Phase III results of our next-generation treatment RTH258,” Dr. Narasimhan said. RTH258 is a novel, single-chain anti-VEGF inhibitor that a Phase II study last year showed was non-inferior to Eylea in treatment of wet AMD.

Novartis has exclusive rights to Lucentis outside the US, and had hoped a successful combination therapy would reverse declining sales of Lucentis as Eylea has gained market share. In the first nine months of this year, Lucentis sales outside the US fell 11%.

“A positive result of the study would have been welcome to add a little pep to waning Lucentis sales,” Zuercher Kantonal Bank analyst Michael Nawrath wrote in a note. “For the small company Ophthotech, this will be much worse than for Novartis, but it’s still a negative result.”

Reuters reported the failure also impacts Roche, of which Genentech is a subsidiary, and which had a deal with Novartis for a share of revenue from Fovista outside the US.

Adnan Butt, senior biotechnology analyst at RBC Capital Markets, told the OIS Podcast that the Fovista results should not derail large companies partnering with smaller companies to develop novel therapies. In October, Ocular Therapeutix and Regeneron entered into an agreement that could pay Ocular up to $315 million in the future. Regeneron hopes to marry Ocular’s sustained-release platform with Eylea. “Certainly, there’s room for smaller companies to remain interesting and intriguing to everybody in the space,” Butt said.

However, as Ophthotech shows, a disappointing trial can hit a small company like pneumonia, or worse.

1. Jaffe GJ, Ciulla TA, Ciardella AP, et al. Dual antagonism of PDGF and VEGF in neovascular age-related macular degeneration. Ophthalmology. DOI: http://dx.doi.org/10.1016/j.ophtha.2016.10.010. Published online: October 28, 2016.

OIS Index Performance Percentage