OIS Index Underperforms Benchmarks in First Quarter Since Inception

In October, OIS partnered with EyeQ Research to launch the OIS Index, a composite of ophthalmic growth stocks, to track the investment performance of our sector.

Our goal is to highlight ophthalmology investment performance, in absolute terms and compared with broader biotech and medical device industries, as well as the stock market as a whole.

We’re disappointed to report that the OIS Index underperformed all of these benchmarks in its first quarter.

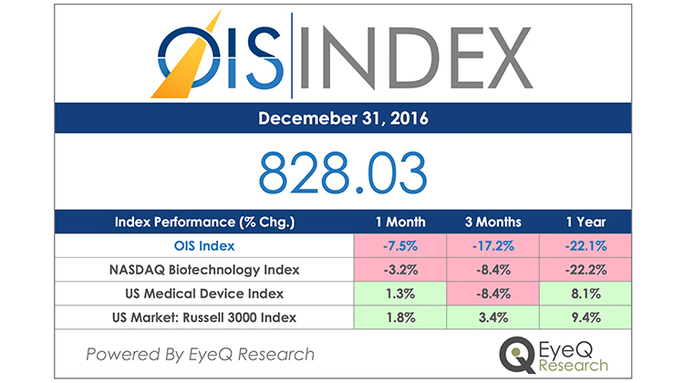

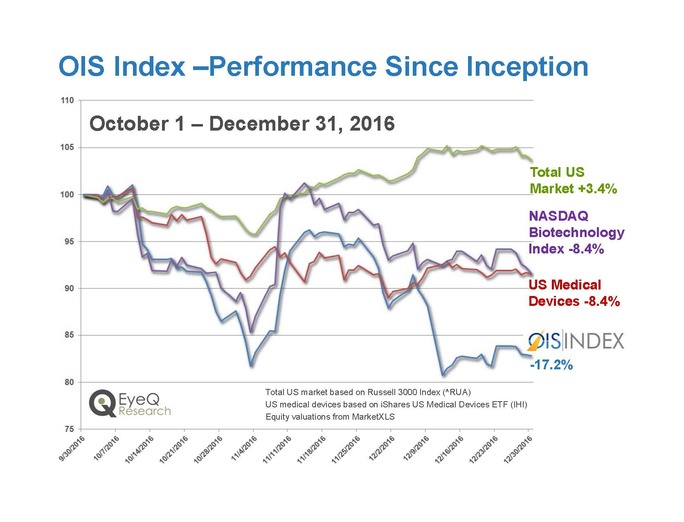

Since October 1, the start of Q4 2016, only six of the 29 stocks that comprise the index increased in value. Over that time, the OIS Index declined in value by 17.2%, from 1,000.00 to 828.03.

Over the same period, the NASDAQ Biotechnology Index (NBI) and a composite of US medical device stocks each declined by 8.4%, and the Russell 3000 Index, which represents the overall US stock market, gained 3.4%.

View OIS Index Performance Percentage

We acknowledge that a market sector composite such as the OIS Index is fundamentally more volatile than larger, more diversified indices.

We track fewer companies – the OIS Index started out with 29 securities, compared with approximately 180 in the NBI, the largest of which have broad portfolios of marketed products and deep, diversified pipelines. In contrast, many of the highest value companies in the OIS Index are smaller and at earlier stages of development. Several of the largest components of the OIS Index have a very limited number of marketed products (or none at all), and just a few key R&D development programs. As we have seen, a single, high-profile pipeline success or failure for one company can have a significant impact on the OIS Index.

It didn’t take long for the OIS Index to succumb to these vulnerabilities. All of the underperformance of the OIS Index compared with the broader biotech and medical device indices during Q4 2016 can be accounted for by just two stocks within the index:

- Ophthotech Corp. (–7.2% impact on OIS Index performance, stock down 89.5%). In December, the company announced that Fovista had not met the primary endpoint in two pivotal Phase III trials in wet age-related macular degeneration (AMD). This pipeline setback alone accounted for over 80% of the underperformance of the OIS Index relative to the broader biotech and medical device indices during Q4.

- Clearside Biomedical Inc. (–2.5% impact on index performance, stock down 48.5%). In the two weeks prior to the October 1 launch of the OIS Index, Clearside’s stock doubled, from about $8 per share to about $17. During Q4, the company announced and completed a secondary stock offering that raised approximately $36 million, during which time the stock declined to $9 per share, reversing the gains seen between mid-September and mid-December.

Other drivers of negative performance of the index in Q4 include:

- Spark Therapeutics Inc. (–1.4% impact on index performance, stock down 16.9%).

- Inotek Pharmaceuticals Corp. (–1.3% impact on index performance, stock down 35.7%). (See below for update.)

- Second Sight Medical Products Inc. ( –1.0% impact on index performance, stock down 44.0%).

- Other large-percentage stock declines of at least 30%, but with less than 1% impact on the index due to smaller market caps, include Escalon Medical Corp. (–83.6%), Ohr Pharmaceutical Inc. (–47.0%), pSivida Corp. (–43.2%), Imprimis Pharmaceuticals Inc. ( –34.4%), and Aldeyra Therapeutics Inc. (–31.6%).

Following a difficult fourth quarter, the OIS Index got off to an inauspicious start to the new year. On January 3, the first trading day of 2017, Inotek Pharmaceuticals announced that the first pivotal Phase III trial of trabodenoson for glaucoma did not achieve its primary endpoint, sending the stock lower by 70% following the announcement. This sent the OIS Index down another 0.9% to 820.87, versus a 2.0% one-day gain for the NBI.

The Good News

We don’t want to ignore the positive stories that contributed to index performance in the quarter. Ocular Therapeutix Inc. (+0.5% contribution to index performance, stock up 21.8%) was the highest percentage gainer in the OIS Index in Q4, driven by positive top-line results from the company’s Phase III clinical trial of DEXTENZA for the treatment of postsurgical ocular inflammation and pain.

Other eye care companies that enjoyed positive Q4 stock performance are:

- STAAR Surgical Co. (+0.9% contribution to index performance, stock up 15.4%).

- Carl Zeiss Meditec Inc. (0.3% contribution to index performance, stock up 2.6%).

- Opthea Technologies Ltd. (0.2% contribution to index performance, stock up 15.8%).

Index Updates

OIS (partnered with EyeQ Research) will continue to actively manage the index and monitor performance. On January 1, the OIS Index was rebalanced and updated based on the latest company share counts. In addition, three new components were added, bringing the total number of securities to 32.

As of January 1, ophthalmic device companies account for 32.5% of index valuation, up from 29.8% on October 1. The remaining 67.5% of index valuation represents ophthalmic biopharmaceutical companies.

The new members of the OIS Index are:

- Realm Therapeutics Inc. (AIM: RLM) – In Q4 2016, the company divested its supermarket retail business to focus on drug development in ophthalmology and dermatology, and changed its name from PuriCore plc.

- KalVista Pharmaceuticals Inc. (NASDAQ: KALV) – In Q4 2016, the company merged with Carbylan Therapeutics Inc. and is now focused on drug development in diabetic macular edema (DME) and hereditary angiodema (HAE).

- Ellex Medical Lasers Ltd. (ASX: ELX) – Identified as an appropriate component of the OIS Index following the October 1 launch of the index.

We’ll continue to bring you regular updates on the OIS Index in our new monthly Eye on Five. If you have comments or questions about the index, feel free to reach out to Michael Lachman.

Michael Lachman is President of EyeQ Research, which provides market research, analytics, and strategic advisory to ophthalmic companies and investors.

OIS Index Performance Percentage